BOB RTGS 2024: The RTGS system is primarily meant for large-value transactions. The minimum amount to be remitted through RTGS is Rs 2 lakh. Bank of Baroda RTGS Form, Rules, Timing, Charges & How to do RTGS?: BOB RTGS form rules timing charges. With Real Time Gross Settlement (RTGS) you can transfer funds to any bank across India in real time.

Quick Links

In what way it is beneficial to the Customers

Customer can remit funds to the account of another bank branch and the funds are transferred instantaneously at nominal charges

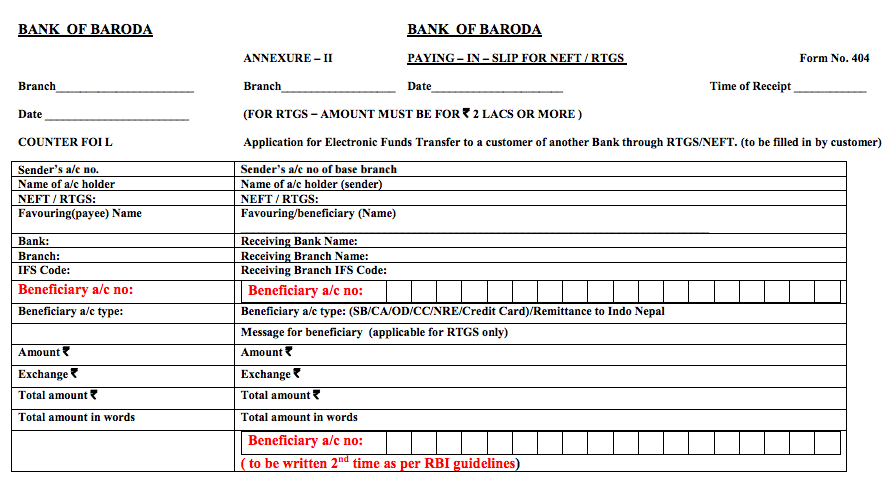

Bank of Baroda RTGS Form

RTGS forms can also be obtained from Bank of Baroda branches.

BOB RTGS Timing

The Bank of Baroda Real Time Gross Settlement System (RTGS) facility is now available 24 hours a day, seven days a week. In this way, India has come to select countries of the world that operate RTGS system round the clock throughout the year. About a year ago, the Reserve Bank started providing the NEFT facility 24 hours. NEFT is a popular method of small-value transactions. Come, let’s know about the 5 benefits of RTGS here.

Minimum and Maximum Amount for Transfer

- Minimum: Rs. 200000

- Maximum: No Limit

BOB RTGS Charges

Offline RTGS Transfers (Through Bank Branch):

- ₹2 lakhs to ₹5 lakhs:

- 8:00 AM to 11:00 AM: ₹25 per transaction (excluding GST)

- 11:00 AM to 1:00 PM: ₹27 per transaction (excluding GST)

- After 1:00 PM: ₹30 per transaction (excluding GST)

- Above ₹5 lakhs:

- 9:00 AM to 12:00 noon: ₹55 per transaction (excluding GST)

- 12:01 PM to 3:30 PM: ₹56 per transaction (excluding GST)

- After 3:30 PM: ₹61 per transaction (excluding GST)

Online RTGS Transfers (Through Net Banking or Mobile Banking):

- Free: There are no charges for RTGS transactions initiated online via BOB’s net banking or mobile banking services.

How to Send Payment via RTGS

There are two ways to send payment via RTGS and one of them is 1. RTGS via Online Internet Banking and 2nd is RTGS via Bank Branch.

RTGS via Bank Branch : If you want to make RTGS via offline mode i.e from Bank Branch then you need to visit your nearest Bank of Baroda Branch and Request for RTGS Form or Slip and Fill all the require details asked in RTGS Form and submit to Cashier, Now you bank brach send payment to another person within 2 working hours

RTGS Via Internet Banking : You may also send money via RTGS by using your Bank of Baroda Internet Banking Service, for using Internet banking, you need to login at Bank of Baroda Website and then you will require to add new Beneficiary and then you are able to make payment via RTGS. Online RTGS is enabled for all customers of Bank of Baroda (Internet Banking) with full transaction right.

When is the amount credited in the beneficiary account?

- Bank of Baroda RTGS is open 24×7, 365 days.

- Transactions, once confirmed will be immediately debited from the source account and taken up for processing. Transactions initiated before the cut off time shall be processed on the same day.

- All transactions initiated outside the RTGS hours and on RTGS holidays will be processed (for onward transfer to beneficiary bank) only on the next working day. Please ensure that there are sufficient funds in your account to process the transaction. In case you are retrying, please check the status of your previous transaction

- Please note that once the amount is debited and processed from Bank of Baroda, the credit into the beneficiary account is completely dependent on the destination bank

What is the time frame to schedule an RTGS transaction?

The time frame to schedule an RTGS transaction in advance is 3 working days. You can pay for transactions like:

- Cash Management Transfer

- Hedging

- Interest

- Loan

- Securities

- Supplier Payment

- Tax Payment

- Trade

- Trade Settlement Payment

- Value Added Tax Payment

If the above-mentioned option is not relevant to the transaction you would like to select. Then please select “Cash Management Transfer” as a default option

Recommended Articles