HDFC Bank NEFT Form 2025: With e-Monies National Electronic Funds Transfer you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further than before. With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India.

Quick Links

Who can avail HDFC Bank NEFT facility

Individuals, firms, or corporations maintaining accounts with a bank branch can transfer funds using NEFT. Even such individuals who do not have a bank account (walk-in customers) can also deposit cash at the NEFT-enabled branches with instructions to transfer funds using NEFT.

- Customers of the branch where they are having Savings/Current Accounts

- Walking customers for below Rs. 50,000.

In what way it is beneficial to the Customers

Customer can remit funds to the account of another bank branch and The funds are transferred instantaneously at nominal charges

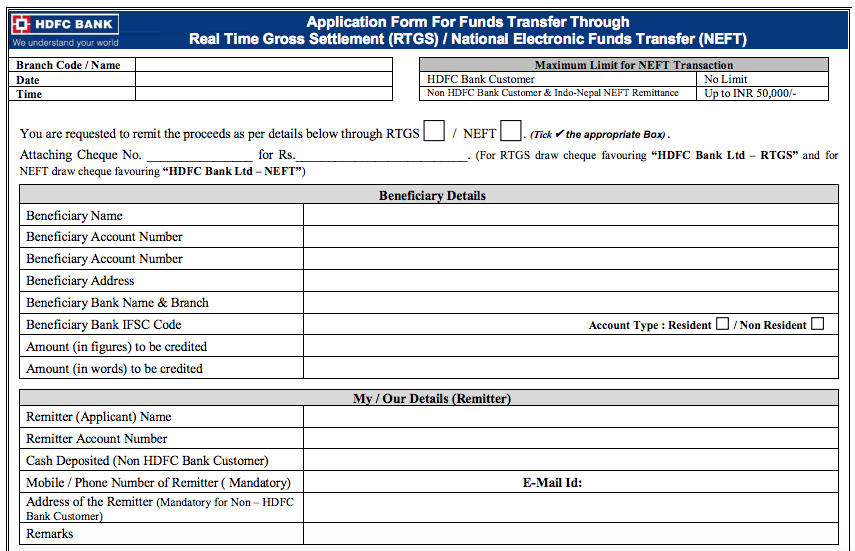

HDFC Bank NEFT Form

HDFC Bank NEFT Form in PDF Format (Official)

Minimum and Maximum Amount for Transfer

- Minimum: Rs.1

- Maximum: Rs 2 Lakh

HDFC Bank NEFT Charges

| Mode of Transaction | Charges |

| Online modes (i.e. internet banking, Mobile app) | No Charges |

| Through Bank branches | |

| Upto Rs 1,00,000: | Rs 2 + Applicable GST |

| Above Rs 1,00,000: | Rs 10 + Applicable GST |

How to Send Payment via NEFT

There are two ways to send payment via NEFT and one of them is 1. NEFT via Online Internet Banking and 2nd is 2. NEFT via Bank Branch..

NEFT Via Internet Banking: You may also send money via NEFT by using your HDFC Bank Internet Banking Service, To use Internet banking, you need to login at HDFC Bank Website and then you will be required to add new Beneficiary and then you are able to make payment via NEFT. Online NEFT is enabled for all customers of HDFC Bank (Internet Banking) with full transaction right.

If you would like to avail HDFC Bank NEFT Facility then please download the application form or visit to your HDFC Bank Brach and submit the duly filled form to your base branch. If you are already a HDFC Bank Connect customer with “view right” and would like to avail full transaction right, please resubmit your application form (which can be downloaded from the above URL) to you base branch.

To use E-Monies National Electronic Funds Transfer you will need to begin by adding a beneficiary. Then you can go on to make a funds transfer or Credit card payment.

To add a beneficiary –

Both the NetBanking and Third Party Funds Transfer facilities should be enabled. (If you’re not yet registered, just fill the form at your closest HDFC Bank branch).

You should have your beneficiary’s IFSC handy. You can get this from the beneficiary bank.

When the above is complete you can follow these steps:

- Step 1 – Log into HDFC Bank NetBanking, using your Customer ID and Password

- Step 2 – Go to Fund Transfer tab.

- Step 3 – Click ‘Add a Beneficiary’, and then select Beneficiary Type – Transfer to other bank

- Step 4 – Enter the beneficiary account or Credit card number

- Step 5 – Select the IFSC, using the bank and branch name. Now you can add the beneficiary. Remember, this is a one-time process.

- Step 6 – Click ‘Add’, then ‘Confirm’

- Step 7 – Authenticate yourself at the secure access step, and wait for your confirmation message

The beneficiary will be activated in 30 minutes (due to security reasons). The Beneficiary can be viewed in the “View Beneficiary” option of the Enquire Section.

Post activation of a beneficiary,

- Rs. 50,000 (in full or parts) can be transferred for the first 24 hours.

- Rs. 100,000 (in full or in parts) can be transferred for the first 48 hours.

An added beneficiary to whom no funds are transferred for more than 24 months, is treated as a new beneficiary in all respects.

A maximum of 7 beneficiaries can be added/modified/deleted in a period of 24 hours.

To make your funds transfer/Credit card payment –

- Step 1 – Go to Fund Transfer tab, and click Transfer to other bank

- Step 2 – Select account, beneficiary, and enter the relevant details.

- Step 3 – Accept the Terms and Conditions

- Step 4 – Review the details, and, if all is correct, confirm to complete the process

NEFT via Bank Branch: If you want to make NEFT via offline mode i.e from Bank Branch, then you need to visit your nearest HDFC Bank Branch and Request for NEFT Form or Slip and Fill all the require details asked in NEFT Form and submit to Cashier, Now you bank brach send payment to another person within 2 working hours

What the customer must have for remittance

IFSC of the bank branch to which the remittance to be made (IFSC is 11 characters code)

Beneficiary account number, Name and Address (to whom the remittance is intended to )

Approach the branch with the above details