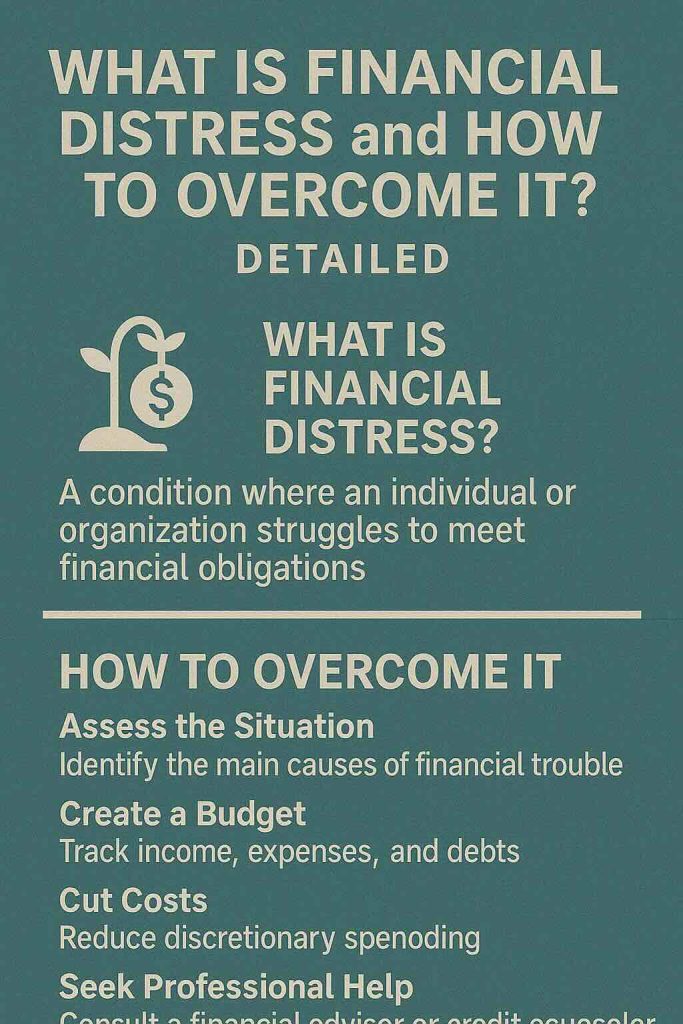

Financial Distress: You must have heard a number of times about situations like Financial Distress faced by various organizations. Some organizations couldn’t survive that, and that led to their insolvency, while others came up with some other source of finance and somehow managed to survive.

Let us first study what Financial Distress is; and how it leads to insolvency, and then let us learn about some sources of financing apart from the traditional modes of Equity and Debt.

Quick Links

Financial Distress and Insolvency

If cash inflows are inadequate, the firm will face difficulties in the payment of interest and repayment of principal. If the situation continues for a long time, there might come a day when the firm would face pressure from creditors for payments.

The firm would find itself in a tight spot. Investors would not invest further. Creditors would recall their loans. The capital market would heavily discount its securities. Thus, the firm would find itself in a situation called distress.

Generally, insolvency occurs after a period of financial distress. Many a times, if financial distress is identified in time and remedial action is taken, the possibility of insolvency can be completely avoided.

Insolvency by contrast, is a decision that the business chooses to take to relieve itself from an excess debt burden. It is a decision where the firm decides to sell its assets to discharge its obligations to outsiders at prices below their economic values i.e., resort to distress sale. So when the sale proceeds are inadequate to meet the outside liabilities, the firm is said to have failed or become bankrupt and after due processes of law are gone through, it might turn out to be insolvent. Must Read Basics of Financial Management.

Some New FinancialInstruments:

Apart from the traditional debt and equity financing, there are other ways too through which the organizations can raise funds. Let us understand a few new and emerging financial instruments.

Option Bonds:

This instrument covers those cumulative and non-cumulative bonds where interest is payable on maturity or periodically and redemption premium is offered to attract investors.

Dual Convertible Bonds:

A dual convertible bond is convertible into equity shares or fixed interest rate debentures/ preference shares at the option of the lender. The fixed interest rate debenture may have certain additional features including higher rate of interest distinct from the original debt instrument

Deep Discount Bonds:

IDBI and SIDBI had issued this instrument. For a deep discount price of Rs. 2,700/- in IDBI, the investor got a bond with the face value of Rs. 1,00,000/-. The bond appreciates to its face value over the maturity period of 25 years. Alternatively, the investor can withdraw from the investment periodically after 5 years. The deep discount bond is considered a safe, solid and liquid instrument.

Commercial Paper:

It is a short-term money market instrument. It is kind of an unsecured promissory note. Its maturity period is between 3 – 6 months. It is readily used to arrange funds for a shorter term.

Factoring:

It is a technique in which the financial intermediary bears the credit risk for the collection of debts from debts.

Forfaiting:

It is a technique in which the Forfaitor discounts an export bill and pays ready cash to the exporter. It is similar to discounting of a Bill, except for one condition; here the bill is always an Export Bill.

By resorting to any of the modes mentioned above, funds can be raised by the organizations.