How & Where to get loans under Pradhan Mantri MUDRA Yojana (PMMY): Mudra loan under PMMY is available at all bank branches across the country. Mudra loan is also issued by NBFCs / MFIs who are engaged in Financing for micro enterprises in small business activities.

Quick Links

Get loans under Pradhan Mantri MUDRA Yojana (PMMY)

MUDRA loans are extended by banks, NBFCs, MFIs and other eligible Financial intermediaries as no ed by MUDRA Ltd. The Pradhan Mantri MUDRA Yojana (PMMY) announced by the Hon’ble Prime Minister on 8th April 2015, envisages providing MUDRA loan, upto Rs 10 lakh, to income generating micro enterprises engaged in manufacturing, trading and services sectors. The overdraft amount of Rs 5000 sanctioned under PMJDY has been also classified as MUDRA loans under Prime Minister MUDRA Yojana (PMMY). The MUDRA loans are extended under following three categories

- Loans upto Rs 50,000/- (Shishu)

- Loans from Rs 50,001 to Rs 5 lakh (Kishore)

- Loans from Rs 5,00,001/- to Rs 10 lakh (Tarun)

What is MUDRA loan?

As per Department of Financial Services, Ministry of Finance, Govt. of India’s letter No.27/01/2015-CP/RRB dated May 14, 2015 loans given to non-farm income generating enterprises in manufacturing, trading and services whose credit needs are below Rs.10 lakh by all the Public Sector Banks, Regional Rural Banks, State Cooperative Banks and Urban Co-operative Banks will be known as MUDRA loans under the Pradhan Mantri MUDRA Yojana (PMMY). All such loans can be covered under refinance and/or credit enhancement products of MUDRA.

In addition to these Banks, NBFCs and MFIs operating across the country can also extend credit to this segment, for which they can avail financial assistance from MUDRA Ltd., subject to their conforming to the approved eligibility criteria. Eligibility criteria for availing refinance/financial assistance by institutions from MUDRA has been finalized and hosted at MUDRA’s website.

To begin with, based on eligibility criteria, MUDRA has enrolled 27 Public Sector Banks, 17 Private Sector Banks, 27 Regional Rural Banks and 25 Micro Finance Institutions (MFIs – list as per Annexure I) as partner institutions for channelizing assistance to the ultimate borrower.

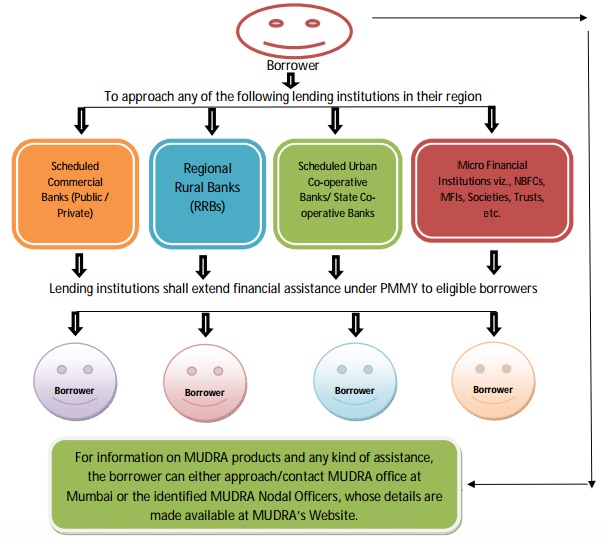

Process Flow Diagram

Whom to approach for assistance under PMMY?

Borrowers, who wish to avail assistance under Pradhan Mantri MUDRA Yojana (PMMY), can approach the local branch of any of the above referred institutions in their region. Sanction of assistance shall be as per the eligibility norms of respective lending institution.

Whom to contact for assistance?

MUDRA has identified 97 Nodal Officers at various SIDBI Regional offices/Branch Offices to act as “first contact persons” for MUDRA.

For information on MUDRA products and for any kind of assistance, the borrower can either approach/contact MUDRA office at Mumbai or the identified MUDRA Nodal Officers, whose details (along with contact numbers and mail ids) are made available at MUDRA’s Website. The borrower may also visit MUDRA website, www.mudra.org.in and can send any query/suggestion to [email protected].

List of MFIs shortlisted (Tentative)

| S.No. | Bank Name | Place in which Registered Office is situated |

| 1 | S V Creditline Pvt. Ltd. | Gurgaon. |

| 2 | Margdarshak Financial Services Ltd. | Lucknow. |

| 3 | Madura Micro Finance Ltd. | Chennai. |

| 4 | ESAF Micro Finance & Investments P. Ltd. | Thrissur, Kerala. |

| 5 | Fusion Micro Finance P. Ltd. | New Delhi. |

| 6 | Ujjivan Financial Services P. Ltd. | Bangalore. |

| 7 | Future Financial Services Ltd. | Chitoor, Andhra Pradesh. |

| 8 | SKS Microfinance Ltd. | Hyderabad. |

| 9 | Utkarsh Micro Finance P. Ltd. | Varanasi |

| 10 | Equitas Micro Finance Pvt. Ltd. | Chennai. |

| 11 | Sonata Finance Pvt. Ltd. | Allahabad. |

| 12 | Saija Finance Private Ltd. | Patna. |

| 13 | Arth Micro Finance Pvt. Ltd. | Jaipur, Rajasthan. |

| 14 | Shikhar Microfinance Pvt. Ltd. | Dwaraka, New Delhi. |

| 15 | Navachetana Microfin Services Pvt. Ltd. | Haveri, Karnataka. |

| 16 | Samasta Microfinance Ltd. | Bangalore. |

| 17 | Satin Credit Care Network Ltd. | Delhi. |

| 18 | Sahyog Microfinance Ltd. | Bhopal. |

| 19 | Arohan Financial Services P. Ltd. | Kolkata. |

| 20 | Cashpor Micro Credit | Varanasi |

| 21 | Digamber Capfin Ltd. | Jaipur |

| 22 | Bhartiya Micro Credit | Lucknow. |

| 23 | Sakhi Samudaya Kosh | Solapur. |

| 24 | Midland Microfin Ltd. | Jalandar. |

| 25 | RGVN (North East) Microfinance Ltd. | Guwahati. |

Note :

1) These institutions have to submit their latest financial status/position and submit loan application for availing of financial assistance from MUDRA Ltd.

2) The MFIs although registered in a particular centre or a state can also operate in other centres and states, according to their bye laws. Accordingly, these institutions cover most of the States.

Interest rate

Interest rates are to be charged as per the policy decision of the bank. However, the interest rate charged to ultimate borrowers shall be reasonable. Scheduled Commercial Banks, RRBs and Cooperative Banks wishing to avail of re nance from MUDRA will have to peg their interest rates, as advised by MUDRA Ltd., from me to me.

CHECK LIST:

(The check list is only indicative and not exhaustive and depending upon the local requirements at different places addition could be made as per necessity)

- Proof of identity – Self certified copy of Voter’s ID card / Driving License / PAN Card / Aadhar Card/Passport.

- Proof of Residence – Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter’s ID card, Aadhar Card & Passport of Proprietor/Partners/Directors.

- Proof of SC/ST/OBC/Minority.

- Proof of Identity/Address of the Business Enterprise -Copies of relevant licenses/registration certificates/other documents pertaining to the ownership, identity and address of business unit

- Applicant should not be defaulter in any Bank/Financial institution.

- Statement of accounts (for the last six months), from the existing banker, if any.

- Last two years balance sheets of the units along with income tax/sales tax return etc. (Applicable for all cases from Rs.2 Lacs and above).

- Projected balance sheets for one year in case of working capital limits and for the period of the loan in case of term loan (Applicable for all cases from Rs.2 Lacs and above).

- Sales achieved during the current financial year up to the date of submission of application.

- Project report (for the proposed project) containing details of technical & economic viability.

- Memorandum and articles of association of the company/Partnership Deed of Partners etc.

- In absence of third party guarantee, Asset & Liability statement from the borrower including Directors& Partners may be sought to know the net-worth.

- Photos (two copies) of Proprietor/ Partners/ Directors.

Recommended Articles

Good

This is the fitting weblog for anyone who needs to seek out out about this topic. You understand a lot its virtually hard to argue with you (not that I really would want…HaHa). You positively put a brand new spin on a topic thats been written about for years. Nice stuff, just nice!

I AM IN NEED OF BUSINESS LOAN,UNDER THE PRADHAN MANTRI MUDRA YOJANA FOR EXPANSION OF MY BUSINESS.