ICICI Bank Account holders can obtain icici bank statements as per there wish. One can obtain bank statement for a day, a month, a quarter or a year, as per their need. Banks usually provide account statements on a monthly, quarterly or yearly basis free of cost. All you have to do is while filling up the account opening form, you have to select the option how would you like to receive the bank statement, whether in electronic form or in physical form.

Quick Links

ICICI Bank Statement

Question: In case an account statement is issued to account holders via electronic mode i.e. through email in pdf format, whether the statement is protected, if yes how to open the same?

Answer: The account holders who have subscribed for receipt of account statement in electronic form receive the account statement in pdf format via email, which is password protected. The password instructions are provided in the same mail itself and hence account readers should read the instructions or opening the account statement. Usually the password is the combination of first 4 letters of the account holder’s name and date and month of birth.

For example, Mr. ABCDEFGH’s date of birth is 01-01-2000, then password would be ABCD0101.

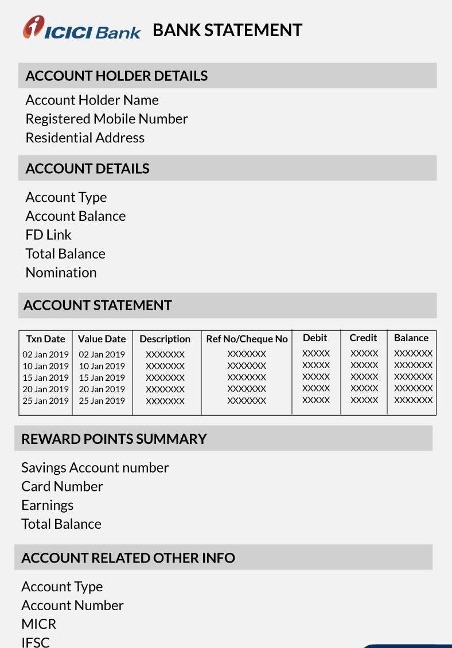

Format of ICICI Bank Statement

The above image is the format of ICICI bank Statement. The statement can be divided into three sections.

- Account Holder details which includes Account Holder Name, Registered Mobile Number and Residential Address

- Account details which include account type and balance, Total Balance, Nomination etc.

- Transaction History which includes all the transactions recorded both debit and credit side with date, amount and other details which may include cheques number.

Ways to Download ICICI Bank Statement

There are different means by which account statements can be obtained. While filling the account opening form, bank gives the account holders the option to select the mode by which they would like to receive the bank statement whether in physical form or electronic form. If account holders select the physical form, they need to visit the branch to get the bank statement. In case account holders select electronic mode, bank statement will be mailed monthly to the registered email id.

Charges

Bank statements are usually issued monthly and quarterly, although account holders can get the bank statement as per the period specified by them. ICICI bank charges Rs. 200/- in case account holders wish to receive bank statement monthly in physical form.

The charges for issuance of bank statement depend on the frequency and mode of issuance of bank statement. The charges are as follows:

| Frequency of Bank Statement | Mode of receipt | Amount (In Rs.) |

| Monthly | Free | |

| Monthly | Physical | 200.00 |

| Quarterly | Physical | Free |

Generally the statements received on email are in pdf format and are password protected. The email itself contains the details regarding how to open the pdf file. Account holders should carefully read the details.

Statement on Mobile

Bank statements can also be viewed with the help of internet banking and mobile banking. Account holders who have registered for mobile banking can download the imobile app on their smartphones. Enter the requisite credentials to login. After login you can access the account statement by selecting the account number and time period.

Internet Banking

Internet banking facility can be availed by those account holders who have registered for availing the said facility and should have User ID and password to access the bank. For viewing the balance through internet banking, following steps should be followed:

- Login to ICICI internet banking using the User ID and password.

- Next click on “E statement”.

- Select the account number, time period and click ok to generate the bank statement.

- The Bank statement will be displayed on the screen. Account holders can also download the same.

Benefits of ICICI Account Statement

Bank statements are of great use to the account holders. The benefits are described below:

- The basic benefit is that it helps the account holders to keep the track of their funds.

- It also helps account holders to identify the spending habits.

- Sometimes bank may charge certain charges for various services like SMS service, ATM card services, or penalties for minimum balance etc. The account statement helps to keep the track on same.

Frequently Asked Questions

Is it mandatory to visit the bank branch for bank statement?

Does bank charge any fees for issuing bank statement?

For what time period bank statement can be viewed?

Are bank statement received through email, password protected? If yes, how can account holders view the statement?

How to view ICICI Bank Statement?

How to view/download the bank statement using net banking?

Recommended