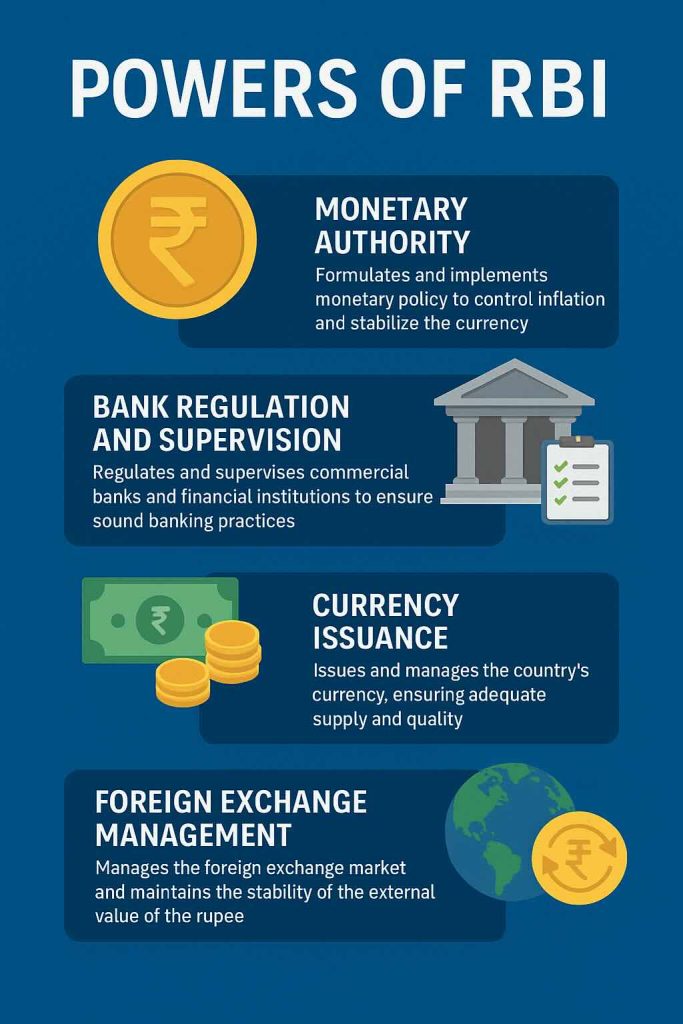

Powers of RBI: Reserve Bank derives extensive powers under RBI Act as well as the Banking Regulation Act, to regulate and supervise various banks in India. An over view of important powers of RBI are given as under:

Powers of RBI

Under Banking Regulation Act the RBI enjoys the following powers:

Section 10 BB – Power of Reserve Bank to appoint Chairman of the Board of Directors appointed on a whole-time basis or a Managing Director of a banking company.

Where the office of the Chairman of the Board of Directors appointed on a whole-time basis or a Managing Director of a banking company is vacant, the Reserve Bank may, if in its opinion that the continuation of such vacancy is likely to adversely affect the interests of the banking company, appoint a person as Chairman of the Board of Directors or a Managing Director of the banking company.

Section 21 – Power of Reserve Bank to control advances by banking companies: Reserve Bank has the powers to determine policies and direct banking companies to follow the same.

Section 22 – Licensing of banking companies: All Banking companies need to get a licence from RBI and it issues licence only after ‘tests of entry’ are fulfilled.

Section 24A- Power to exempt a Co-operative bank: Without prejudice to the provisions of section 53, the RBI by notification in the Official Gazette, declare that, the whole or any part of the provisions of section 18 or section 24, as may be specified therein, shall not apply to any co-operative bank.

Section 27 – Monthly returns and power to call for other returns and information: At any time, the RBI may direct a banking company to furnish it with such statements and information relating to the business or affairs of the banking company (including any business or affairs with which such banking company is concerned) as RBI may consider necessary or expedient to obtain for the purposes of this Act, apart from calling for information every half-year regarding the investments of a banking company and the classification of its advances in respect of industry, commerce and agriculture.

Section 29A – Power in respect of associate enterprises: The RBI may direct a banking company to annex to its financial statements or furnish to it separately, within such time or intervals, necessary statements and information relating to the business or affairs of any associate enterprise of the banking company. It can also conduct an inspection of any associate enterprise of a banking company and its books of account jointly by one or more of its officers or employees or other persons along with the Board or authority regulating such associate enterprise.

Section 30 – Power to order Special audit: In the public interest or in the interest of the banking company or its depositors, the RBI may at any time by order direct that a special audit of the banking company’s accounts.

Section 35 – Inspection of Banking Companies: Reserve Bank on its own or being directed so to do by the Central Government, inspect any banking company and its books and accounts and supply to the banking company a copy of its report on such inspection.

Section 35A – Power of the Reserve Bank to give directions: In the public interest or in the interest of Banking policy RBI has powers to issue, modify or cancel as it deems fit, and the banking companies or the banking company, are bound to comply with such directions.

Section 36 – Further powers and functions of Reserve Bank : RBI may caution or prohibit banking companies or any banking company in particular against entering into any particular transaction or class of transactions

- On a request by the companies concerned and subject to the provision of section 44A, assist, in the amalgamation of such banking companies.

- Give assistance to any banking company by means of a loan or advance in terms of under section 18 of the RBI Act.

- Direct the banking company to

- call for a meeting of Directors or

- discuss such matters with Officers of RBI,

- depute an officer to such meeting, appoint observers to such meetings

- furnish information of such meetings

- make changes in management.

In addition to the above the RBI has also been vested with powers to remove managerial and other persons from office(section 36AA), to appoint additional Directors (section 36AB), to issue directions in respect of stressed assets (Section 35AB), Supersede Board of Directors in certain cases(Section 36ACA),Supersede Board of Directors of a multi-State Co-operative bank (Section 36AAA) and also to impose penalty (Section 47).

In addition to the above, RBI also enjoys certain powers vis-a-vis banks under RBI Act as per the following table

| S.no | Power | Section |

|---|---|---|

| 1 | Power of direct discount. | 18 |

| 2 | Power to require returns from co-operative banks. | 44 |

| 3 | Power to collect credit information. | 45B |

| 4 | Power to call for returns containing credit information | 45C |

| 5 | Power to determine policy and issue directions | 45JA |

| 6 | Power to call for information from financial institutions and to give directions. | 45L |

| 7 | Power to regulate transactions in derivatives (excluding capital market derivatives), money market instruments | 45W |

| 8 | Power of Bank to depute its employees to other institutions | 54AA |

| 9 | Power of the (RBI’s) Central Board to make regulations | 58 |

Recommended Articles