Navi app 2024: Navi is a very creative and interesting application that provides loans to everyone, without a lot of paperwork and documentation. Though there are some eligibility criteria, those are very minimal and it won’t bother a lot. Also, the documents required are very few, everyone possesses that many documents from their childhood. The app provides a personal loan of up to 5 lakhs, which is a very good deal. Also, it gives a tenure of up to 36 months to repay the loan. In this article, we will give details about Instant personal loan apps.

Quick Links

Navi Personal Loan Feature

The Navi app interest rate can be chosen very easily and you can decide the tenure and amount as well. Navi not only provides personal loans, but it also provides home loans and few others as well. Because of the very easy and hassle-free process, many are now shifting their way towards this app. As the loan amount is not huge, anyone can take it for any kind of work. The flexibility which this loan app provides is quite appreciable.

This is a blessing for many middle-class families. Even old people can take out loans very easily from the app. The interface is very smooth and the money is directly credited to your bank account.

| Interest rate | 16 % to 36 % per annum |

| Processing fee | 3.99 % of the loan amount |

| Features | With the help of the Navi application, you can easily take a loan directly into your bank account. There is no need for a lot of paperwork and stuff |

| Eligibility criteria | You must be a citizen of India, otherwise, you can’t take a loan from the app. The loan is available in only select cities of India. Loan taker’s Age must be above 18 to take a loan |

| Application process (Online/Offline) | This is an online process. It won’t provide any offline assistance. You need to install the app first from the play store |

| Documents Required | I’d proof – Aadhaar card, voter ID card, etc. and Pan card for a successful KYC |

| Play Store link | Click here |

Eligibility criteria

Some eligibility criteria must be followed at any cost to get the loan. This app is a new addition to this business and it has achieved a lot of success in very littlele time. The addition of this easy and hassle-free loan app provides a lot of flexibility to all middle-class families. Now for small loans, you can easily rely on the Navi app.

Some of the eligibility criteria are:

- You must be a citizen of India, if you want to take the loan from this app.

- As the app is still growing, the service is only available in a few cities, and those who don’t live in these cities can’t take the loan. This is a big problem, but the company is solving it.

- You must be an adult, with age more than 18, or 18.

Documents required

There are only two documents required to take a loan from the Navi app. As a personal loan, itself asks for very few documents and security, and above that, we are taking a loan from the Navi app, which itself demands very few documents. Although the loan is unsecured, so you don’t need to provide any collateral and security.

The two needed documents are:

- Identity proof – Aadhaar card, voter ID card, etc.

- Pan card for successful KYC registration.

Application process (Online/Offline)

The application process is very simple, as it doesn’t require a lot of paperwork and documentation. It is a completely online process and you can take a loan from anywhere. You need to visit the application if you want the loan. The whole idea behind launching the app was to improve the quality of loans and to make it a little bit easier and hassle-free. Through the online process, the application becomes very easy and simple. Anyone can apply for a loan and especially, old age people can have a lot of assistance. They can take out a loan from their mobile phones.

Now, we will discuss the application process:

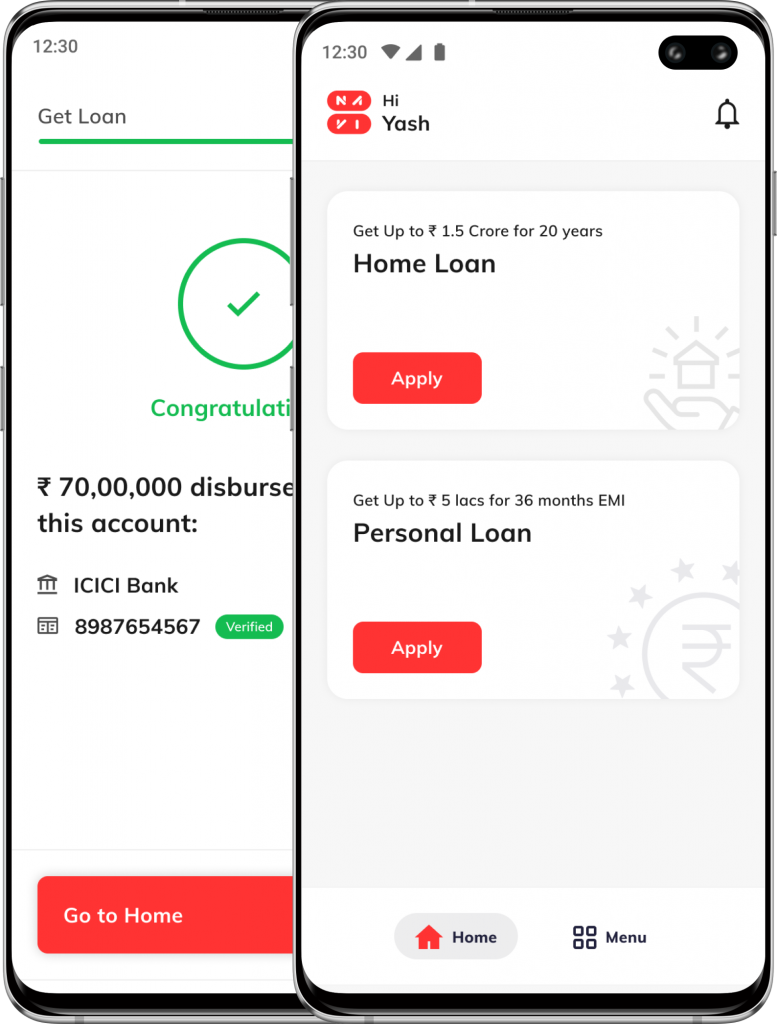

#Step I – First of all, you need to download the Navi app from the Google play store. As it is only available on Android devices.

#Step II – You need to sign up on the application by using the same number, which is registered in your Aadhaar card and bank account.

#Step III – Now you need to submit some more details about yourself and your address and identity. Once you complete the form, you are good to go.

#Step IV – Then select your desired loan amount and the interest rate. Also, choose the tenure in which you want to repay the loan.

#Step V – Complete your KYC by providing some simple details about your pan card and your Aadhaar card. You should be asked to submit a video KYC for further safety.

#tep VI – And then submit the bank details, to which you want your money to be credited.

#Step VII – Once everything is checked, instant money will be transferred to your bank account.

Frequently asked questions

Yes, the interest rate is slightly on the higher side, but looking at the features and ease at which you get your loan, it’s acceptable. There are minimal documents required and also the process is very fast and easy.

It depends on your trust and faith in the company. It’s better to check the company’s background before taking any loan, and in this case, the company is quite safe and trustworthy.

Yes, the Navi loan app is an RBI-registered non-banking financial company (NBFC). It provides instant loan transfer to your bank account, a paperless process with flexible EMI’s.

Yes, one can easily get personal loans for up to Rs. 5 lakhs through the Navi app. The loan is sanctioned within 10 minutes if you have the required documents such as PAN Card, Aadhaar card and a selfie.