Banking

Search

All Categories

- All Categories

- Aadhaar

- Accounting

- Actors

- Actress

- Age

- Artist

- Auditing

- Author

- Axis Bank

- Badminton Player

- Bajaj Finserv

- Balance Enquiry

- Bank Account

- Bank Holidays

- Bank Jobs

- Bank of Baroda

- Bank of India

- Bank PO Jobs

- Bank Statement

- Banking

- Banks in India

- Baseball

- Basketball Player

- Boxer

- Business

- Business

- Business Loan

- Businessman

- Businesswoman

- cacom

- Canara Bank

- Car Loan

- Car Loan Rates

- Cards

- Celebrity

- CEO

- Chef

- Cheque

- Coach

- Comedian

- Commentator

- Company

- Company

- Company Law

- Credit Card

- Cricketer

- Customer Care

- Dancer

- Debit Card

- Demand Draft

- Director

- DJ

- Economics

- Economy

- Education Loan

- Entertainment

- Entrepreneur

- EPF & UAN

- Fashion Designer

- Federal Bank Personal Loan

- Film Composer

- Film director

- Film producer

- Finance

- Fixed Deposit Rates

- Football coach

- Football Player

- Gold

- Gold Loan

- Golfer Player

- Govt Bank Jobs

- Govt Schemes

- GST

- HDFC Bank

- HDFC Bank Personal Loan

- Hero FinCorp

- Hockey

- Hollywood

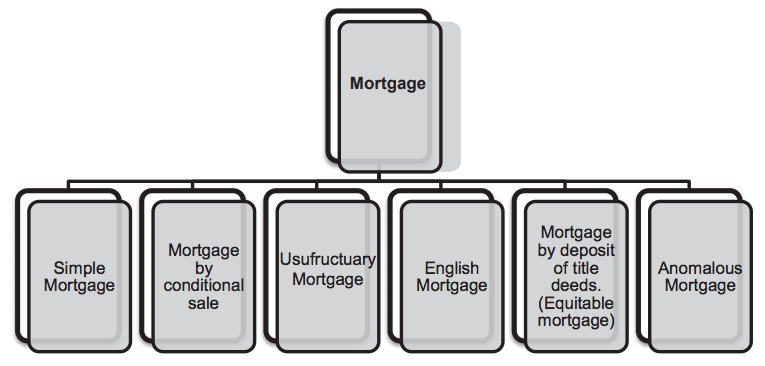

- Home Loan

- Home Loan Interest Rates

- Home Loan Rates

- HR Formats

- ICAI

- ICICI Bank

- ICICI Bank Personal Loan

- IDFC FIRST Bank Personal Loan

- IndusInd Bank

- Invest

- Investment

- Jeweler

- Jockey

- Journalist

- Kotak Mahindra Bank

- Lawyer

- LIC Housing Finance

- Loan Against Property

- Loans

- Media personality

- Model

- Money

- Music Artist

- Mutual Fund

- NBA

- NBA Players

- Net Banking

- Net Worth

- News

- NFL Players

- Olympians

- Olympics

- Online Loan

- People

- Personal Loan

- Personal Loan Interest Rates

- Personal Loan Rates

- Politician

- Private Bank Jobs

- Professor

- Profile

- Property Loan

- Punjab National Bank

- Race Car Driver

- Rapper

- RD Interest Rates

- Real Estate

- Representative

- Result

- Richest DJs

- Richest Families

- Rock band

- RTGS

- Saving Account

- Scientist

- Share Market

- Shark Tank

- Singer

- Songwriter

- Sports

- Startup

- Stock

- Stuntman

- Tally

- Tennis

- Tennis Player

- TV Personality

- Two Wheeler Loan

- UPI Apps

- Wealth

- Wrestler

- Writer

- YES Bank

- YouTuber

DESC

- DESC

- ASC