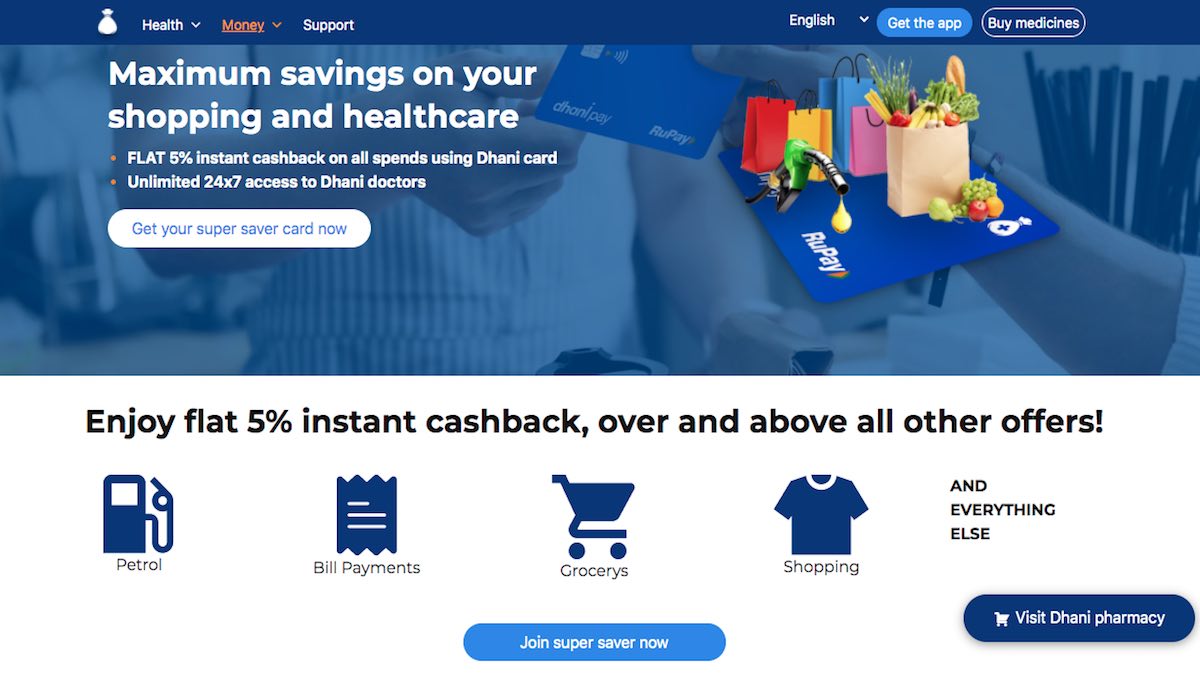

Dhani 2024: How to get the Dhani super saver card? Dhani, super saver card, is a vet successful and acknowledged innovation that is praised by everyone. Dhani offers a great deal in the form of this card, and you can get access to various features by owning that card. You will receive a cashback of 5 % on every transaction made with the card. There are a lot of partner companies of Dhani as well, who provide some special discount and cashback to all its customers, who pay them through Dhani super saver card. In this article, we will give details about Dhani and other related to it.

Quick Links

Features of Dhani Super Saver Card

There are also excellent features of the app, which makes it very special. You can also get cashback on the payment of petrol and other things. You can remain in touch with doctors 24*7. You can also use the benefits of network hospitals, which is a very convenient and comfortable thing to have. Especially for those who are suffering from some disease, this is a blessing. Also check HDFC Freedom Credit Card, Paytm sbi credit card, Paytm Next Generation Credit card.

| Features | With the help of the Dhani super saver card, you can get access to plenty of cashback and rewards. You can get the card without minutes by following simple steps. There is also the benefit of having 24*7 medical support from Dhani |

| Eligibility criteria | You need to be an Indian if you want to get the Dhani super saver card. It would help if you had a regular monthly income to access the Dhani super saver card. You need to have work experience as well, although that is not required for salaried employees. |

| Application process (Online/Offline) | The application process is entirely online and hassle-free. You can quickly fill the application either from its official website or from the Dhani app. Anyone can apply for the Dhani super saver card if they are eligible for it. |

| Documents Required | There are some documents you need, like identity proof, address proof, pan card, and a few others. |

| Get Your Super Saver Card Now | Click Here |

Eligibility criteria

There aren’t a lot of eligibility criteria that you need to be worried about. You can quickly get the Dhani super saver card at the comfort of your home. The app provides a very fantastic service and security. It is also approved by RBI, and all the payments and transactions made from the app are entirely transparent to RBI and everyone. You can also track all the details about your remaining credit on the card and about all the cashback and other things.

We have mentioned the eligibility criteria below:

- The applicant who wants to get the Dhani super saver card, needs to be an Indian.

- You need to have a regular source of income, so that you can repay the debt in time.

- Your credibility and your credit score also plays a big role. Although, if you have had any credit card earlier, then you can get the card a lot more easily.

- Your age must have to be more than 21, to be able to get the card.

- You also need to have some scanned images of documents at the time of application process. Those are very important documents for a successful card approval.

Application process (Online/Offline)

The application process to get the Dhani super saver card is very easy and convenient. Any can apply for the super saver card without any hassle and worries about paperwork and documentation. As the entire process is online, you can easily submit all the documents online. All you need to do is to have the scanned image of the required documents.

Step I – first of all, you need to download the app from either the play store or its official website.

Step II – once you have downloaded the app, you can now quickly get registered on the app. Once you are registered on it, you can log in and submit some of the essential details about yourself.

Step III – You need to fill the application form for the Dhani super saver card in this step. Once you are fine with it, you can upload the scanned image of the required documents.

Step IV – after you have uploaded the documents, submit the application form and pay the fees asked during the process. Now you need to sit back and relax until the check is over. Once it’s over, you can expect the card to be delivered within a few days. Till then, you can use the virtual card, which is allotted to you via the Dhani app.

Read more about: Insider Trading

Documents required

The documents required to take the Dhani super saver card are mentioned below:

- Identity proof – Aadhaar card, passport, voter id card, etc.

- Address proof – Aadhaar card, driving license, passport, etc.

- Income proof, for that you can either use the bank statement of the last few months or you can also use the most recent salary slip. Although the salary slip can only be submitted by a salaried employee and the bank statement can be submitted by a self -employed person.

- A pan card is necessary as well for KYC.

FAQs

– Yes, the Dhani card is acceptable to all the merchants around this country. Also, this is powered by Rupay, so you don’t have to be worried.

– Don’t worry at all. You can easily block your card directly from the Dhani app. This app allows you to use all the features of the card directly.

– Do note that you cannot withdraw money from ATMs using your Dhani Pay card.

You can get this card instantly with up to 5 lakhs of the credit limit.

Recommended: