What is UPI?: Unified Payments Interface (UPI) is an instant payment system developed by the National Payments Corporation of India (NPCI), an RBI regulated entity. UPI is built over the IMPS infrastructure and allows you to instantly transfer money between any two parties’ bank accounts. UPI Payment Address is an Address which uniquely identifies a person’s bank a/c. For instance, the Payment Address for BHIM customers is in the format xyz@upi.

You can just share your Payment Address with anyone to receive payments (no need for bank account number/ IFSC code, etc.). You can also send money to anyone by using their Payment Address. Note: Do not share your confidential UPI PIN with anyone. now check more details for “What is UPI? (Unified payment interface), How is it better than IMPS?” from below…….

Quick Links

What is UPI? Unified payment interface

UPI is an instant payment system which facilitates the transfer of money among different banks using a single unique address (VPA). It is basically an application based interface which can be ideally used in a smartphone. UPI has been developed by the National payments corporation of India (NPCI) an RBI regulated entity to boost the digital fund transfer in the country. UPI is an advanced version of Immediate payment service (IMPS).

Different channels for transferring money through UPI:

Money can be transferred using below credentials as the channels on UPI

- Virtual payment address

- Aadhar Number

- Account number + IFSC

- Mobile number + MMID

How is it better than IMPS:?

| S.No | Aspect | IMPS | UPI |

|---|---|---|---|

| 1 | Bank account details of the other party/beneficiary | Required | Not required |

| 2 | IFS code of the beneficiary bank | Required | Not required |

| 3 | Can you ask your customer for the payments due from him? | No | Yes |

| 4 | Transaction Charges (For more details on this refer the below table) | Minimum Rs 5 | As less as 50 paisa |

| 5 | Payment success rate | Normal | Higher than IMPS |

Highly cost effective

You can even use it for smaller amounts without bothering about the transaction charges. Here is a comparison of the transaction charges among NEFT, RTGS, IMPS and UPI.

| Transaction amount | NEFT | RTGS | IMPS | UPI |

| upto ₹ 10,000 | Free | NA | Free | Free |

| above ₹ 10,000 and upto ₹ 1 lakh | Free | NA | Free | Free |

| above ₹ 1 lakh and upto ₹ 2 lakh | Free | NA | Free | NA |

| above ₹ 2 lakh and upto ₹ 5 lakh

(Incl. ₹ 2 lakh for RTGS) | Free | ₹25 + ST | NA | NA |

| ₹ 5 lakh and upto ₹ 10 lakh | Free | ₹50 + ST | NA | NA |

ST = Service tax; NA = Not applicable.

How to transact using UPI app:

UPI is an application based system which requires the user to download the UPI app. There are several UPI apps available in the apps store. Example: BHIM, SBI pay, HDFC Mobile, Phonepe, PNB UPI etc., You can choose any of them. Each bank can launch its UPI-based APP. Banks can also incorporate UPI features into their existing mobile application. Many banks have configured the UPI features in their existing banking app. you can download any UPI enabled app. It can be from your bank or from any other bank.

Unlike Mobile wallets, one does not require to transfer funds into the UPI app. Though every fund transfer takes place through your bank account, UPI app just acts as the link between you and your bank account.

To establish the link between you and your account, you have to integrate UPI app with your bank account. It is a one-time process which can be done when you download a new UPI app. The UPI payment system gives you the flexibility to connect many bank account to one VPA. In fact, you can add all of your bank account to one UPI app.

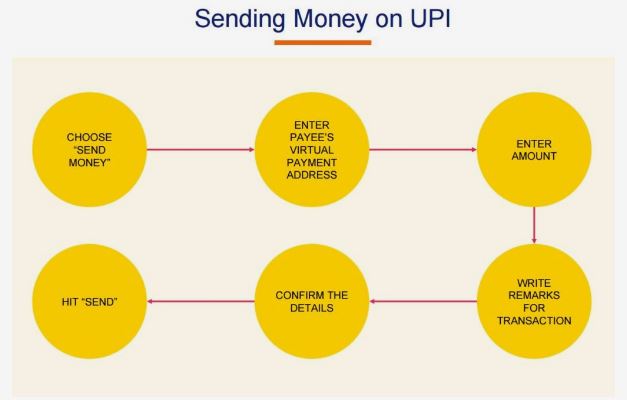

How to send money:

A passcode (PIN) should be set which is used to open the app.

After opening the app, click on send money. Then choose the bank account from which you want to send money. If only one account is linked, then it acts as a default account. Next, select the receiver using the VPA. VPAs of different payees get automatically saved in the app as you keep on doing the transactions with them. Enter the amount then confirm. Then you will receive an MPIN and the same should be entered to finish the transaction. Finally, you can the transaction status once it is done.

Banks having UPI enabled:

Majority of the banks have enabled the UPI. This is a long list : SBI, ICICI, HDFC, Andhra bank, Axis bank, Bank of Maharastra, Canara bank, Catholic Syrian bank, DCB, Federal bank, Karanataka bank, PNB, South Indian bank, United bank of India¸Vijaya bank, OBC, TJSB, IDBI, RBL, Yes bank, IDFC, Standard chartered bank, Allahabad bank, HSBC, Bank of Baroda, Kotak Mahindra bank and IndusInd.

Recommended Articles

- ICICI UPI App

- United Bank UPI App

- UPI APP Download

- Axis Pay UPI App

- PNB UPI App

- SIB UPI App

- Vijaya UPI App

- What is VPA

- Karnataka Bank UPI App

- SBI UPI App

- Canara Bank UPI App

- Union Bank UPI App

- BHIM App

If you have any suggestion or query regarding “What is UPI? (Unified payment interface), How is it better than IMPS?” then please tell us via below comment box….