Rufilo Loan app 2024: Features, Eligibility, Documents Required. Rufilo has been a sensation since its inception in the online lending platform. It provides one of the most accessible and convenient loans to every individual in India who is eligible for it. You can take a maximum of 25,000 instant loans within five minutes. There are also plenty of other features available like; you can get a list of gift cards and various other coupons for different e-commerce websites and shoes. This article will give you all the details related to Rufilo app.

Quick Links

Features of Rufilo App

Many have been in partnership with Rufilo, and they are India’s biggest e-commerce platform like Flipkart, Myntra, Makemyshow, etc. There is also an imposing feature of Rufilo. You only need to have an aadhaar card for all your identity verification and address verification, and KYC. This makes it a lot more convenient and flexible.

There are also plenty of repayment options available to give the customers more flexibility. The customer support is also quite phenomenal. You can expect a service of 24*7 with all the proper help.

| Features | Rufilo is India’s one of the most famous and successful platforms from where you can take easy and convenient loans and credit lines for all your usage. You can get an instant loan of 25,000 within a few minutes, and the process is also very smooth and hassle-free. As it is entirely online, you don’t need to do any paperwork and documentation. |

| Eligibility criteria | Some eligibility criteria must be known, like; you need to be a citizen of India, you need to have a regular source of income, your age must have to be either equal to 21 or more than that, you need to have a good credit score and few more. |

| Application process (Online) | The application process is straightforward and convenient to complete. The entire process is online, which makes it even easier and hassle-free. You can take out a loan within five minutes. Just download the app from the play store or from anywhere else. After downloading, you can fill the application form and get approval within minutes. |

| Documents Required | You don’t need to have a lot of documents to get a loan from Rufilo. You need to have an aadhaar card to do all kinds of identity checks and address checks, as well as for KYC. Although you do need an income proof |

| Official App | Click Here |

Eligibility criteria

You need to know some eligibility criteria if you want to take a loan from the Rufilo app. However, these eligibility criteria are nothing new and neither special. It’s pretty simple and known to most of those who have taken loans before. Although for beginners and amateurs, it’s essential.

To read more about: Powers of RBI (Reserve Bank of India Powers)

We have mentioned all the eligibility criteria below:

- First of all, the applicant must have to be a citizen of India to be able to take a loan from Rufilo app.

- You need to have a regular and stable source of income, so that the loan repayment remains smooth.

- You also need to have a certain minimum monthly salary to begin with.

- Your age must have to be either equal to 21 or more than that.

- You need to have a good credit score to take a loan without any troubles.

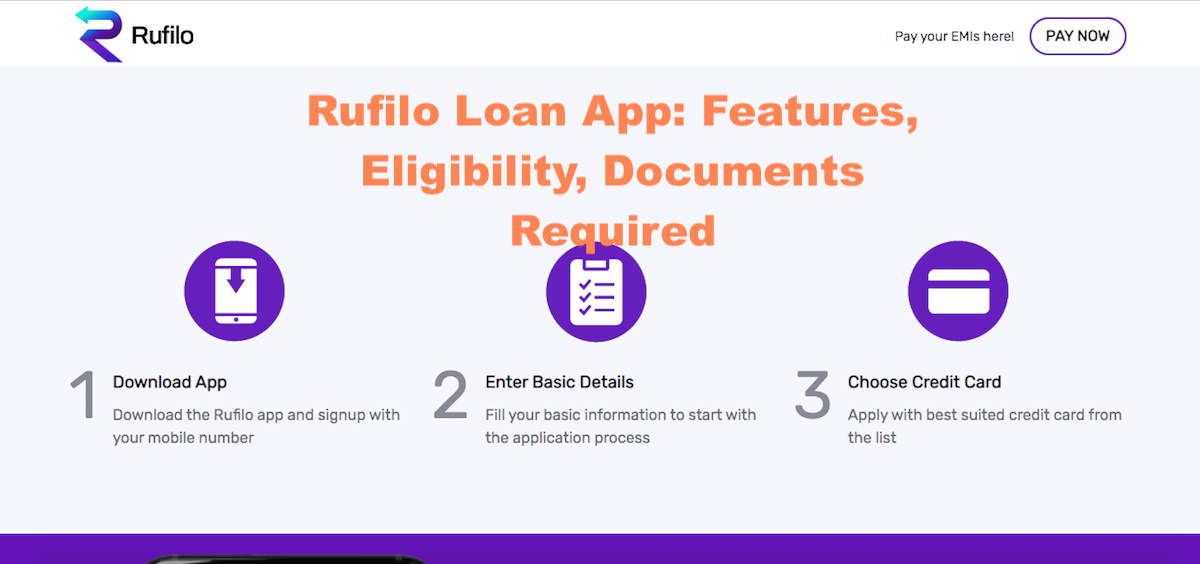

Application process (Online)

The application process is speedy and easy to apply for. You can easily apply for a loan from the Rufilo app without a lot of trouble. You can do all the processes online, which makes it even more flexible. However, the app doesn’t provide its services to all the states in India, so check the listed States before applying for a loan.

We have mentioned all the steps to take a loan from the Rufilo app below:

#Step I – first of all, you need to download the Rufilo app from the play store or any other app store.

#Step II – now, you can also check further details by visiting the official website, www.rufilo.com; you can check all other information from the website.

Step III – After downloading the app, you need to get yourself registered on the application by providing your phone number and bank account details.

#Step IV – Once you are registered with the app, you need to fill out the application form and select everything like tenure, loan amount, interest rate, and a few other things.

#Step V – once the application form is filled, you can upload the scanned image of the documents required. After the documents are uploaded, you can submit the application form.

Step VI – after submitting all the documents, you need to wait for a few minutes, as the app does some verification and confirmation. Your loan amount will get transferred to your bank account directly.

Documents required

We have mentioned all the documents required below:

- You only need to have an aadhaar card to do all the verification, KYC and other. You can use the aadhaar card as an identity proof, address proof, etc.

- You need to have an income proof like, the most recent salary slip or the bank statement of the last few months. You can also submit the income tax return or other relevant documents.

- A picture of yours is also required for which you can use a selfie.

Frequently asked questions

You can easily avail of many discounts and cashback on shopping through Rufilo credit on the partner website.

Yes, your credit will either become good or bad. It depends on you, as if you keep a good relationship with Rufilo, your credit score will surely improve with time.

Yes, there are plenty of options to repay the debt. You can pay either through UPI or Paytm or Debit card, or others.

Yes, its service is quite phenomenal, and you can expect a service 24*7. It is pretty known for its exemplary service and safety.

Recommended